In the previous post, we looked at the evolution of cross-sectional cable capacity as enabled by improvement in submarine cable technology along the trans-Atlantic corridor. But as internet demand continues to increase, the question remains: Can capacity growth meet bandwidth requirements between North America and Europe? Let’s explore this question further.

Capacity Growth Rate for Trans-Atlantic Cable Systems

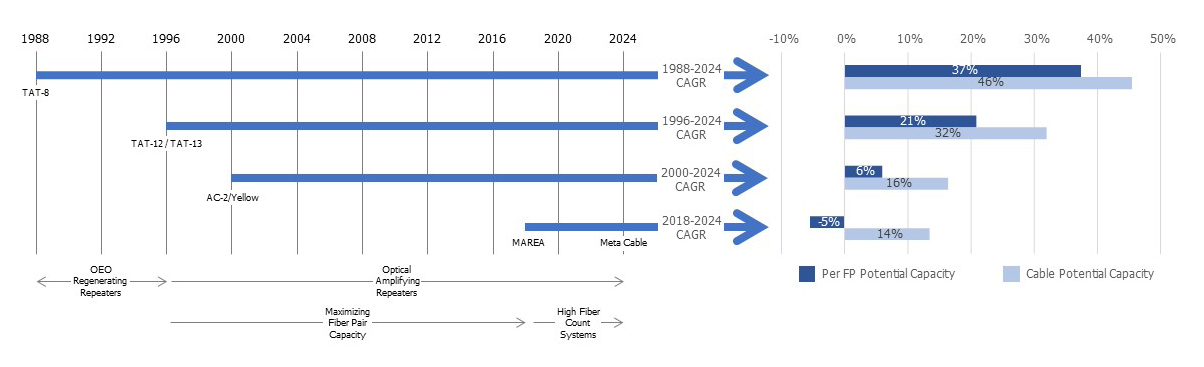

Figure 2 illustrates at what pace cross-sectional cable capacity has been increasing over the past few decades. When looking at the first fiber optic trans-Atlantic cable system, and considering the latest expected trans-Atlantic system to enter into commercial service in 2024, cross-sectional cable capacity has increased at a 46% Compound Annual Growth Rate (CAGR).

Figure 2: Capacity Growth Rate for Trans-Atlantic Cable Systems Over Four Different Time Periods

Figure 2: Capacity Growth Rate for Trans-Atlantic Cable Systems Over Four Different Time Periods

If we focus on optically amplified cable systems (starting from the TAT-12/13 cable system), the cross-sectional cable capacity growth rate is reduced from a CAGR of 46% to 32%. If we look at the period from 2000 to 2024 and from 2018 to 2024, the cable capacity growth rate further slows to a CAGR of 16% and 14%, respectively.

If we assume the installation of a 32-fiber pair cable system in 2026, with a per-fiber-pair capacity of 18 Tbit/s, the 2024 to 2026 cable capacity growth rate would be equivalent to a CAGR of 10%. These CAGR figures show that, despite all the new technologies discussed thus far, the pace at which the trans-Atlantic cable system cross-sectional capacity is increasing over time appears to be inexorably slowing down.

Figure 2 also shows that the growth of per-fiber capacity is slowing on a CAGR basis. As previously referenced, since 2018 the industry is experiencing a decrease in per fiber capacity. However, this is compensated for by the increases in fiber count, which nevertheless enable an increase in cross-sectional cable capacity.

Capacity Supply and Demand across the Atlantic Ocean

On the bandwidth demand side, telecom market research firm TeleGeography reported a 50+% CAGR for the used trans-Atlantic bandwidth between 2015 and 2021. For the midterm, trans-Atlantic bandwidth demand is expected to grow at a CAGR close to 35% over the 2022-2027 period.

It is obvious that these numbers illustrate a clear disconnect between traffic growth rates on the demand side and cable technology on the supply side.

At the SubOptic Conference in 2019 and the PTC (Pacific Telecommunications Council) Conference in 2020, TeleGeography addressed this supply and demand discrepancy within the trans-Atlantic route and concluded that more cable systems will be required to cope with the projected demand growth rate. Assuming an aggressive potential roll-out scenario (which includes the implementation of 32-fiber-pair and 50-fiber-pair cable systems capable of transmitting 20 Tbit/s per fiber pair in 2023 and 2025, respectively), TeleGeography forecasted the need to have two new trans-Atlantic cable systems in service in 2020, one more in 2021, and one additional system in 2024.

Two years later in 2022, it is worth looking at what happened, and what is happening over the next few years, within the trans-Atlantic “seascape.”

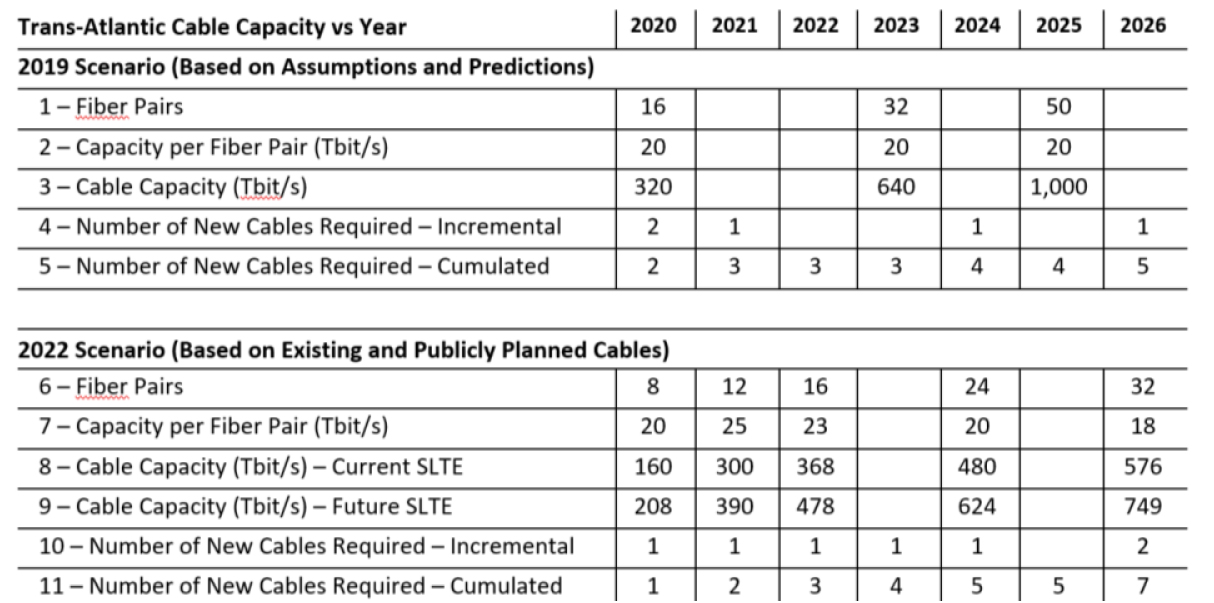

Table 1: Trans-Atlantic Cable Capacity vs Year per 2019 and 2022 Scenarios

Table 1: Trans-Atlantic Cable Capacity vs Year per 2019 and 2022 Scenarios

The top half of Table 1 corresponds to the scenario built by TeleGeography in 2019 to assess the number of new trans-Atlantic cables required (Lines #4 and #5) in order to accommodate traffic demand. This scenario was based not only on the forecasted traffic demand growth rate, but also on an assumed technology evolution scenario described in Lines #1 to #3.

The bottom half of the table is fed by existing cable systems (Havfrue in 2020, Dunant in 2021, and Grace Hopper in 2022) and new cable systems that have been publicly announced (Amitié in 2023, and the Meta cable in 2024). Line #8 provides an estimate of the cable capacity based on current SLTE technology, while Line #9 corresponds to cable capacity enabled by potential future SLTE technology.

The 2022 scenario confirms the 2019 vision: More cable systems are required (and have been built) to meet bandwidth demand. The 2019 scenario, however, may have been reliant on a technology evolution that appears to have been slightly too aggressive, as this scenario underestimates the number of new cables required in 2026 by 28% (and overestimates technology improvement in the subsea industry).

The submarine cable industry may need to accept that current and future system technologies may not be able to offer the required increases in capacity to meet the needs of expected bandwidth demand growth rate over the next several years. This discrepancy in the supply and demand growth rate can be solved by:

- Building more cable systems to stay ahead of bandwidth demand needs.

- A profound electrical, mechanical, and/or optical redesign of subsea cable systems to enable packing and powering more fiber cores and optical amplifiers (such a redesign may not be available for another five to 10 years).

- A radical modification within the content delivery chain.

With regards to the content delivery chain, this cannot be achieved by simply building more caching locations near Internet end-users. The development of numerous caching locations over the past two decades has not prevented the trans-Atlantic traffic to grow at a 35+% CAGR. This means that an increased supply in submarine cables is likely the best path forward for the industry to address growing bandwidth demand across the Atlantic Ocean, at least over the next three to five years.

It is clear that internet demand will only continue to increase. The industry must act swiftly if we are to keep pace.

Our blog series exploring cable capacity and the current climate’s ability to meet user demand will continue in the following posts, which will examine the situation across the Pacific Ocean.

For comments or questions, please contact us.

Sources: https://blog.telegeography.com/the-mystery-of-international-bandwidth-demand